Bildquelle zu oben: vom Original-Handout für Konferenzteilnehmer (grafische Qualität der Scan-Kopie nicht optimal) –>

Sehr geehrte Leserinnen und Leser!

Bevor ich mit dem eigentlichen Inhalt dieses Beitrags beginne, weise ich Sie wieder auf den permanenten Basis-Beitrag Nr. 0 mit meinen allgemeinen Informationen zur ‚Blattlinie‘ dieses Blogs hin: Download des Informationsbeitrags zur Blog-‚Blattlinie‘ (Link zu PDF-Zweiseiter mit allen Informationen, kurzgefasst).

Darin erfahren Sie unter anderem auch, was es mit dem obigen Übertitel „A.R.T.-Blog“ auf sich hat… —

[Noch kurz eine redaktionelle Fußnote zu diesem Blog, als Hinweis in eigener Sache: der Blogbeitrag Nr. 1 war 29./30.01.18 einen Tag lang irrtümlich völlig deaktiviert gewesen. Dieser web-technische Fehler entstand durch das Schreiben dieses Beitrags Nr. 2 . – Falls Sie zufällig grade an diesem einen Tag 29.01. auf den Fehler gestoßen sein sollten: sorry für die Leerseite & Fehlermeldung! Ich werde den technischen Website-Status hinkünftig noch sorgfältiger überprüfen, um solche technischen Fehler zu vermeiden…]

Nun aber der heutige Blog-Beitrag Nr. 2, diesmal besser in der Konferenzsprache Englisch, zum Thema:

Summary of three opening statements at the international conference

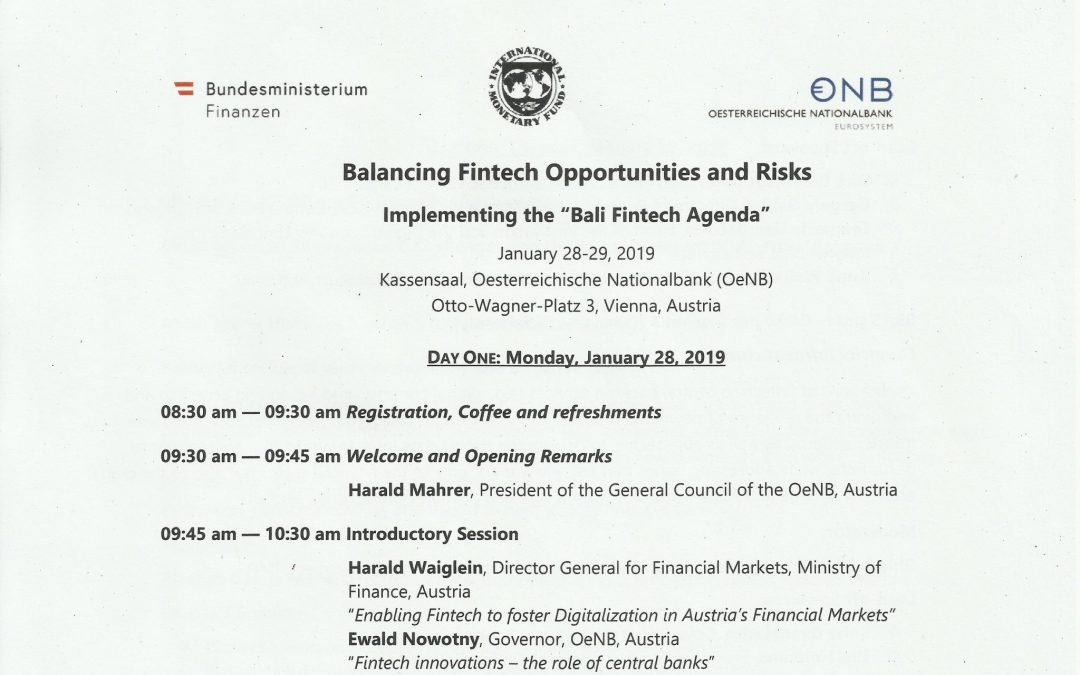

„Balancing Fintech Opportunities and Risks: Implementing the Bali Fintech Agenda„ at OeNB, organised by JVI – 28./29.01.2019, Vienna

On 28. and 29.01.2019, the Joint Vienna Institute ( www.jvi.org ) as conference organiser, and the Austrian Federal Ministry of Finance – together with the Oesterreichische Nationalbank (OeNB) as host for the venue – had invited to a 2-day, international and high-level conference on the topic as above. Here you find the official OTS press release before the conference. –

The press release by OeNB had already announced even four opening keynote speakers on the first day’s morning session. Given that this part of the conference program on the first morning was open also for the press, I took the opportunity to register some days in advance and to attend also myself this ‚almost‘ public part of the conference.

The premises of the OeNB „Kassensaal“ (an ample event hall for large audiences in the OeNB building’s first floor) offered the appropriate venue for this conference.

Besides the, roughly estimated about 250 participants from many central banks and regulatory institutions from Europe – and apparently some non-European countries – also several prominent participants from the Austrian institutions were present at the opening session: Mr. H. Ettl, one of the two Board Members of the Austrian Financial Markets Authority (FMA) – Mr. F. Rudorfer, Chairman of the Division „Banks and Insurance Comp.s“ of the Austrian Chamber of Commerce (WKO) – and from the OeNB, besides the official participants as named on the Agenda, e.g. also the two OeNB Directors Mrs. K. Hrdlicka (Dept. Supervision of Significant Institutions) and Mr. J. Turner (Statistics Dept.) – among a few others, not mentioned here. –

Important Note:

The following summary of 3 (out of 4) opening statements is just the result of my very personal notice, i.e. it represents no authorised report and does not claim any completeness or verbal presision in the account for the contents. However, I have done my best to recall for you the important messages from the speakers‘ full-length presentations, as accurately as possible. –

The first speaker was Mrs. Barbara Kolm, the Vice President of the General Council of the OeNB, stepping in in for absent Mr. Harald Mahrer as the President of this OeNB Supervision Board. Actually, her opening statement was separated in the conference agenda as „Welcome and Opening Remarks“ – see the scan copy of the original conference program, at top above.

The official biography of Mrs. Kolm taken from the OeNB webpages provides a good overview of her several different offices, besides being the OeNB General Council Vice President. –

Main messages of the opening statemement by Mrs. Kolm:

The current developments in the fintech industry are a challenge both for regulators resp. legislators, and for the market players and stakeholders. Over the last 2 years, this fintech development proceeded very fast, also in Europe, and global investments in fintech assets have grown to a substantial amount.

The fintech sector will change society, consumer behaviour, and particularly the retail banking system – among many others. The profitability of existing banks can – or will – be eroded by this increasing competition, and classical retail banks will have to look for special market niches, or also prepare for exit strategies in some cases. Many banks are entering strategic cooperations with the fintech „economic system“ already now, be it via collaborations or joint ventures etc.

On the public side, we have to look into the necessary legislation and regulations and decide, for the different fintech industry segments, whether this should work better top-down or bottom-up, and whether with frameworks on a regional or fully international level?

Fintech’s have to gain sufficient trust from consumers, but this will not be feasible for public governmental bodies by simply changing the necessary laws „ex-post“ in the course of the rapid development.

As always, regulators must implement financial stability and consumer protection, also for this relatively new sector of financial markets, and this will inevitably lead to certain restrictions on the allowed business models.

As the fintech industry gains its main drivers from new technology, there is also a need for improving the technological education of the consumers concerned, and regulation should be essentially „technology-neutral“. Different regulatory approaches for fully developed vs. for emerging economies appear to be necessary.

Mrs. Kolm also explicitely addressed the issue of proportionality in fintech regulation, i.e. there cannot be a „one-size-fits-all“ approach for all market participants. This important principle has been sometimes „forgotten in the past“ by different regulatory bodies, according to Mrs. Kolm.

As a self-critical diagnosis she stated that so far, most of the fast fintech developments have „outperformed“ the public sector, when it comes to accompanying legislation and regulation.

Concerning new substantial risks from these developments – in particular cyber risks – serious discussions by governmental and regulating institutions are just starting, Mrs. Kolm stated.

So where are we heading? Only time will tell if we are currently making the right decisions, and conferences like this one are the appropriate means to shape the necessary discussion now.

This way, the fast developments of the fintech industry can offer advantages for consumers.

___

The second speaker was Mr. Harald Waiglein, Director General for Financial Markets at the Austrian Ministry of Finance (BMF). In this function, he also represented the Minister of Finance Mr. Löger who had nominated Mr. Waiglein as the BMF speaker at this conference.

The official BMF sub-webpage for the „DG Economic Policy, Financial Markets and Custom Duties“ lead by Mr. Waiglein represents an overview of his many different tasks. What is more, Mr. Waiglein has been appointed to several key functions at EU level in recent years – this may be gathered from the detailed BMF press release from June 2018.

Main messages of the opening statmement by Mr. Waiglein:

The Austrian perspective on the fintech topic is inseparable from the international framework within the common European SSM (Single Supervisory Mechanism).

So where do we stand, at the EU level – and in Austria, in particular?

At this point, the fintech and digital industry does not pose any danger for financial stability, viewed from the EU perspective. But clearly, the issues of money laundering and consumer protection are very important ones. Mr. Waiglein quoted a recent study by the Brussels-based Breugel Institute ( http://bruegel.org/ ), written at the request of the Austrian EU presidency in the second half of 2018. According to this study, 60% of all Bitcoin currency exchanges to other currencies (‚expected‘ as real currencies) are being executed to other cryptocurrencies instead. Find here the direct link to this Bruegel Institute study . – This shows that „something“ not quite legal resp. legitimate is currently still going on in the crypto assets markets, Mr. Waiglein said.

Mr. Waiglein mentions that he has been on a number of panels dealing with fintech and digital asset topics. According to his personal view, these different topics have to be distinguished into the really promising ones, vs. the just temporarily „hyped“ topics. The two fintech market segments which are certainly very promising are new payment services on the one hand, and clearing and settlement innovations on the other. Mr. Waiglein deems that fintech’s will never make banks superfluous, but that banks‘ business might change considerably within the next 10 years – yet still, banks will continue to play an essential role in the long run.

The key elements of the EU fintech action plan as highlighted by Mr. Waiglein are the following:

- Creating models for regulatory sandboxes: results of a quite recent ESA’s surveillance from beginning of January 2019 (ESA’s = European Supervisory Authorities, jointly – i.e.: ESMA, EBA and EIOPA ) point to two types of fintech regulation models: the mentioned sandbox models, vs. the so-called innovation facilitator type of models. The survey includes 21 member states in 3 different European economic areas, of which 5 member states including Austria have already implemented one of the two regulatory models; and in addition three EU member states plus one EEC country are currently preparing for this regulatory implementation.

- None of the existing regulatory sandboxes in Europe so far presumes a model with fintech-related exemptions from the overall regulatory framework.

- An important legislative principle, according to Mr. Waiglein:

„If there are problems with the law, first fix the law – not the other way round.“ - So far there appears to be not quite sufficient communication between these two groups of regulatory authorities, i.e. the ones with innovation facilitator models, and the ones having established regulatory sandboxes.

- An additional level playing field issue is due to existing inconsistencies in transpositions of the relevant EU Directives, in particular of MiFiD I/II – for example concerning the national definitions of a financial instrument subject to MiFiD. If within one member state, an existing fintech financial product is not already classified as some financial instrument under MiFiD, this fintech product type will fall into an „essentially unregulated“ realm in this country.

- Currently the EU member states‘ transpositions of MiFiD entail that most digital assets are not classified as financial instruments, and consequently are not subject of MiFiD regulation. But even if a digital asset category is falling into the national MiFiD definition of financial instruments, additional level playing field problems may arise from certain differences between member states, concerning the resp. transpositions and enforcements of MiFiD.

However, according to Mr. Waiglein it is still „too early for changing the EU legislation on a full scale“, for the appropriate supervision of the fintech economy. –

The Austrian state of affairs as to fintech regulation is now concentrating around the so-called „Fintech Navigator“ on the FMA website . At the level of the Federal Ministry of Finance, there was established a Fintech Advisory Council about one year ago (February 2018).

Mr. Waiglein pointed out that a number of initiatives have been and will be started by this high-level public discussion platform, which could still be expanded in the future. Topics of current evaluation include issuances of capital market securities by fintech’s; apparently some first applications to the FMA for such issuances have been filed. – Another recent concrete example is that of the fintech support for all future issuances of Republic of Austria sovereign bonds, to be aided by blockchain technology for the notarisation of these government bond transactions: see the official OeKB press release from October 2018 on this topic.

A subgroup of the Fintech Advisory Council is currently working on the topic of a technology-neutral regulatory definition for capital market securities, as Mr. Waiglein reported.

In closing, Mr. Waiglein pointed out three major areas of fintech-related legislative work for the near future, here again on the international level:

1. there is currently no framework for banks‘ exposures to digital assets – however, the BCBS is discussing this topic; as an additional hint from this author: see the BCBS Paper 431 (Feb. 2018).

2. accounting of digital assets in banks‘ balance sheets – same situation as for item no. 1 above

3. in the AML regulatory framework, one step further has to be taken, also to cover exchange transactions between digital currencies resp. assets [hint: cf. the Bruegel study mentioned above].

Any steps in this direction taken by the FATF ( http://www.fatf-gafi.org/ ) – see in particular, the direct topical link to the FATF FinTech & RegTech Initiative – will be supported e.g. by the BMF.

____

The third speaker was Mr. Ewald Nowotny, current OeNB Governor. This downloadable PDF with his short biography is taken from the conference handout with all speakers‘ biographies.-

Additional offer here: For all the other speakers except Governor Nowotny (and except Mr. T. Richardson, Director of the Joint Vienna Institute – see further below), the handout of biographies is provided as PDF download for your information.

If you are also interested in the, so far only two press articles published on this conference (count by the end of Jan. 2019), you can simply follow the two direct web links below to these German articles:

Trendingtopics.at and Wiener Zeitung

Both name Governor Mr. Nowotny in their headline – that’s why they are mentioned in this third section of the summary.

Main messages of the opening statmement by Mr. Nowotny:

Governor Nowotny first emphasised the importance of this meeting, as an example of a good cooperation between the OeNB, the BMF and the IMF ( www.imf.org ). –

[Just as an aside, this leads to the remark by this blog’s author that the JVI / Joint Vienna Institute is a cooperative venture of six international organisations – among them the IMF as the lead institution – and the Austrian institutions BMF and OeNB. See on the JVI’s web page: www.jvi.org ]

Mr. Nowotny stated that digitalisation in the financial sector is no new phenomenon – e.g. the e-banking topic as one of the already long-lasting examples – and that the international financial sector overall is on the other hand the biggest investor in the digital economy.

What could be the role of central banks in the fintech developments? Mr. Nowotny names three areas where central banks should play a major part, besides all other stakeholders:

1. Central banks should serve as neutral economic advisors, to provide orientation for new and for established market participants. In Mr. Nowotny’s opinion, technological developments can support, but cannot replace the real currencies or the the well-known financial institutions. Purely technological platforms may be able to complement, but not to replace the „classical“ market participants. The main perspectives for fintech’s are seen in retail banking, by OeNB. –

However, the recent „roller coaster ride“ in the market value of cryptocurrencies shows that the most technologically advanced solutions are not automatically the most successful ones.

In particular for the blockchain technology, the future story has yet to be written. Central banks will observe these developments, but will not restrict them in addition to the actual regulatory authorities – which will have to deal with the important security concerns arising.

2. Central banks continuously support digital economies, e.g. in the realm of instant payments. Mr. Nowotny names two recent initiatives where this role of central banks has been evident:

First the regulatory intitiative PSD2 (EU Payment Services Directive no. 2 ) – where Mr. Nowotny is verbally not so „much worried“ about the resulting problems in Austria, when compared to other EU countries.

And second, the market initiative TIPS (Target Instant Payment Settlement) which went live last year (November 2018). The OeNB promotes Austrian banks to participate in TIPS – not only technologically, but also as a matter of economic independence considerations: The instant payment systems which are in use so far, particularly in Europe, are obviously dominated by the commercial and indirectly also governmental influence of large players in USA or China. TIPS can provide an answer to the important question, who is „harvesting“ the data from all the instant payment transactions in Europe, as here the role of the EU / EEC itself should be considerably strengthened.

3. Central banks may be seen as guardians of financial stability, in particular for ensuring legal certainty, both at the levels of EU and of the BIS (Bank of International Settlements) – and as Mr. Nowotny emphasises, also at the level of the IMF.

In concluding, Governor Nowotny points out that we should stick to realistic expectations:

The „cryptographic machinery“ will not replace the real currencies.

The central banks, in their three main roles for the fintech economy (see above), always follow the latest technological developments. Sometimes the central banks‘ opinions differ from most technology-oriented players; or in very short terms, as put by Mr. Nowotny for a final sentence:

„Our main focus is the Fin, not the Tech“ …

____

Conclusion of this summary – a brief overview also of the remaining conference Agenda:

As already mentioned in the third introductory paragraph at top of this blog page, the above is a summary just of 3 out of 4 opening statements on the first conference morning. The fourth speech of the introductory session was given by Mr. Tobias Adrian, a Financial Counsellor and Director of the Monetary and Capital Markets Department at IMF (cf. also the personal website of Mr. Adrian). You may want to compare also with the biography of Mr. Adrian in the speaker biographies‘ handout, which is provided here as PDF download for your information.

While the author of this blog took notes also of this opening statement by Mr. Adrian; including the summary also of this fourth speech as part of this blog text would exceed the maximum useful length of this blog – which is already more that of a full-size article, than of a blog text.

Luckily, in the case of Mr. Adrian’s opening remarks this is not at all necessary: please read the full original text of Mr. Adrian’s speech as published on the IMF website, so-to-say real-time.

As a brief replacement for including also here the summary of Mr. Adrian’s opening remarks, these two additional direct weblinks to subpages of the IMF website point to:

– a general overview on fintech topics, as a key issue for the IMF; and secondly the so-called

– the „Bali Fintech Agenda“ – which provided the conference title’s second part.

Details on these two topics may be found on the respective sub-pages of the IMF website.

Finally, the readers of this blog may also be interested in scrolling through all session topics of the two conference days, i.e. from the afternoon session of day one (29. Jan), and the morning session of the second half day. These remaining parts of the conference, after the essentially public first morning (accessible for the press), were open to official delegates only. But still the rather detailed 3-page Agenda handout for both conference days can be provided as direct PDF document download (in the same scan format, hence with rather poor print-out quality).

On the second day, another opening statement was given by Mr. Thomas Richardson as the current Director of the Joint Vienna Institute / JVI.

A handwritten note by myself on the third copy page of the Agenda handout (download above) indicates that this 30-minutes introductory talk, entitled: „Fintech Challenges and the Joint Vienna Institute Work Program“ , was within the closed session on day no. 2; i.e. subject to the general restriction „open to officials only„. So the talk’s summary cannot be reported here. –

This appears to be a good point to end this English overview of the conference opening on the first morning; and it may be supposed that for all delegates, the full program was very fruitful.

___

Für Ihre Kommentare – wie immer, gerne auch kritisch – zu diesem Blogbeitrag bin ich natürlich jederzeit gerne zu kontaktieren; dazu nochmals der Hinweis: bitte beachten Sie für Ihr Feedback meine Hinweise im zweiseitigen Download des Informationsbeitrags zur Blog-‚Blattlinie‘ . –

Der nächste Blogbeitrag wird dann – wie bereits im Beitrag Nr. 1 von 20.01.19 am Schluss angekündigt – die konkreten, praktischen Auswirkungen der SREP-Neuerungen auch für LSI’s in Österreich diskutieren; und zwar wie erwähnt: SREP über das engere Thema des Beitrags Nr. 1 ‚Risikotragfähigkeit‘ hinaus.

Dieser nächste Beitrag wird in etwa Mitte Februar 2019 hier erscheinen.

Danke für Ihr Interesse!

Mit besten Grüßen,

Thomas Hudetz